TourTools® has developed a QuickBooks general ledger integration for receivables and payables management. QuickBooks is a leading small-business accounting package. This will allow you to eliminate the redundancy of pushing payment or refunds twice – staff no longer need to manually enter data into TourTools® and then again in QuickBooks.

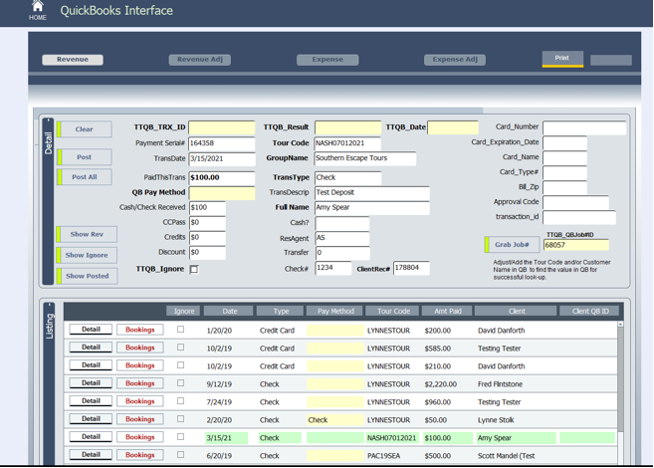

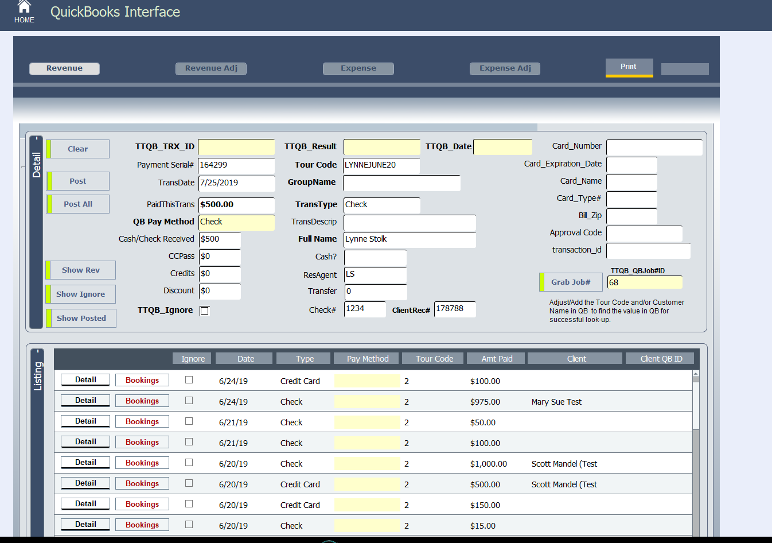

TourTools® users can enter all daily receipts, cash, checks and credit cards and then transfer individual or select groups of transactions directly into QuickBooks.

Each transaction is posted to the appropriate bank, revenue, and expense accounts. Also available: adjust for credit card-related bank changes as part of the transaction.

How it Works

Each transaction references a QuickBooks job# record that is created in the QB Customer Table.

As each transaction is processed, TourTools® checks to see that the job# exists for the associated tour. If a job# is not present in QuickBooks, then TourTools® creates the job# record and posts the transaction.

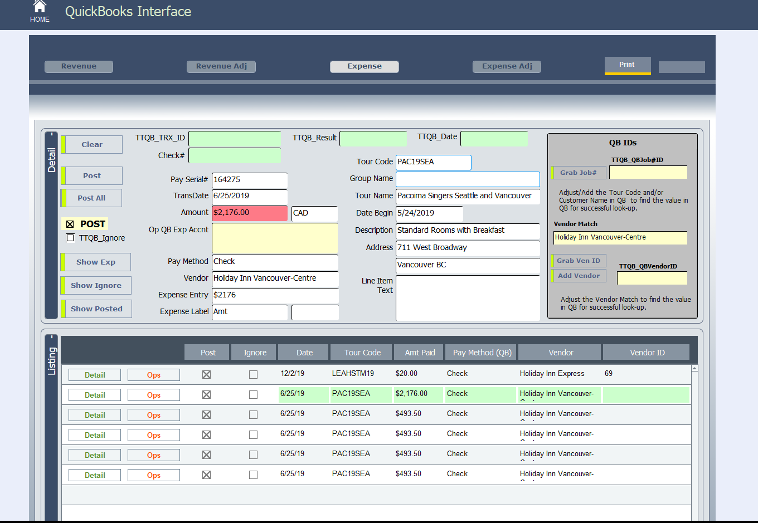

The same process is followed for expense or refund transactions: TourTools® checks to see if the vendor record exists in QuickBooks prior to posting the expense transaction. If no vendor record exists, then TourTools® creates the vendor and posts the payment transaction.

Check Queue Feature

The built-in “Check Queue” feature allows users to select services to be paid and move the transactions from TourTools® into QuickBooks so each bill is ready for payment.

If the service has been paid by a method of payment other than check, then the transaction is recorded as such.

Each transaction is posted to the designated vendor, the job# for the current tour, and the default accounts payable account.

Available Transactions

DEPOSITS

Check deposit to bank account and revenue account (liability account).

Credit card deposit to bank account and revenue account (liability account) with optional calculated bank fee.

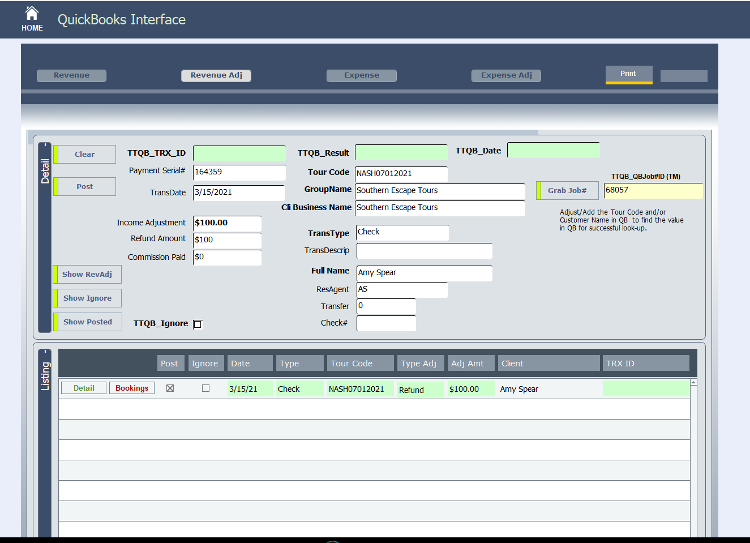

REFUNDS

Check refund to client, from bank checking and revenue account (liability account).

Credit card refund to client, from credit card and revenue accounts (liability account).

VENDORS

Payment to vendor for services rendered, posted as a bill.

Refund from vendor for overpayment, posted as a credit.

NOTE: The customization base price includes the programming required to post expense payments (payables) and receipts (revenue) with debits and credits as well as refunds. Additional functions, as well as more complex transaction postings consisting of multiple debits or credits, are also possible utilizing TourTools and the FM Books Connector plug-in.

Click here to download the full QuickBooks Guide.

Post your comment on this topic.